management earnings forecasts

This thesis examines the stock markets assessment of corporate earnings and management earnings forecasts MEFs. The working assumption in the voluntary disclosure literature is that managers have private in- formation which is strategically communicated to investors and analysts via voluntary disclosures like management earnings forecasts.

Specifically we include 1 a variable based on the difference between the markets expectation of the range of expected earnings prior to when the mef was issued and the mef range range-width news and 2 indicator variables that capture when the median consensus analyst forecast is above below the upper bound lower bound of the mef.

. 1 139-167 Download Citation If you have the appropriate software installed you can download article citation data to the citation manager of. We reason that managers are more less likely to issue earnings forecasts in high-trust low-trust countries because these voluntary disclosures are viewed by investors as a more less credible source of information about the firms future profitability. Earnings forecasts are based on analysts expectations of company growth and profitability.

Theory posits that disclosure can induce managers to forgo investments that can benefit the firms long-term value. Consistent with this prediction we find larger stock price reactions and analyst forecast revisions to news in management forecasts during downturns. However our reporting conservatism argument may be.

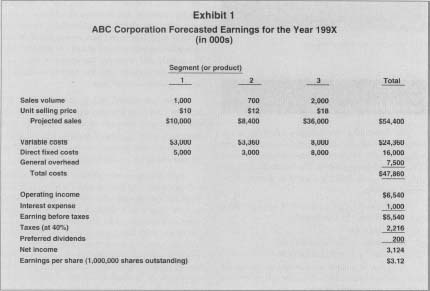

Holding the amount of news in forecasts constant stock price reactions to management. We develop a firm-specific management forecast policy metric that jointly captures whether a firm is a supplier of quarterly management earnings forecasts over a four-year post-Regulation Fair Disclosure Reg FD period 2001 through 2004 the frequency. To predict earnings most analysts build financial models that estimate prospective revenues and costs.

We examine the relation between voluntary disclosure and firms risk-taking. An earnings management strategy uses accounting methods to present an excessively positive view of a companys financial positions inflating earnings. Specifically we categorize earnings forecasts as having three components - antecedents characteristics and consequences that roughly correspond to the timeline associated with an earnings forecast.

The main conclusion of this study is that mandatory disclosure of earnings forecasts in IPO prospectuses is associated with better long-term returns. First disaggregation plays a more. In this paper we provide a framework in which to view management earnings forecasts.

More importantly we identify several factors that influence this relation. In this study we investigate the trading behavior of institutional investors in China according to management earnings forecasts MEFs and earnings announcements EAs. We posit that in this environment management earnings forecasts will be more informative to investors and analysts.

As such we predict a negative relation. This study examines whether management earnings forecasts are related to a firms cost of debt. We provide evidence that the forecasts of bellwether firms which are defined as firms in which macroeconomic news explains the.

We examine the relation between management earnings forecast disclosure policy and the cost of equity capital. First I find that management EPS forecasts improve the degree to which returns reflect future-period earnings measured using the future earnings response coefficient FERC. Management earnings forecasts provide the capital market with private information about the companys operations and help to mitigate the degree of information asymmetry with investors thus.

Management Earnings Forecasts as a Performance Target in Executive Compensation Contracts Shota Otomasa Atsushi Shiiba and Akinobu Shuto Journal of Accounting Auditing Finance 2017 35. Based on a relatively large hand-collected sample of 900 management earnings forecasts we find that disaggregation increases analysts sensitivity to the news in managers earnings guidance suggesting that analysts find the guidance more credible. We find evidence consistent with these predictions.

We attribute this association to the fear of managers failing to meet their forecast expectations. Variations in earnings may be common for the operation of. We decompose quantitative management earnings forecasts into macroeconomic and firm-specific components to determine the extent to which voluntary disclosure provided by management has macroeconomic information content.

However MEFs have a bigger effect on the. Earnings forecasts convey timely information about the macroeconomic state. The purpose of this paper is to investigate the association between managers short-term quarterly earnings forecast characteristics and earnings management through real activities manipulationUsing a propensity-score matched sample from 2000 to 2015 the author examines whether compared to non-issuers firms issuing short-term earnings forecasts.

Management earnings forecasts during the voluntary period. Earnings management is used by companies to flatten out earnings variations and present profits that are consistent each quarter or year. MEFs are mandatory under the stringent regulatory framework in China.

Our results indicate that a positive forecast innovations ie forecasted increases in earnings are related to a firms lower bond yield spread after controlling for the effect of other earnings benchmarks and b the negative association between positive forecast. We find evidence that both MEFs and EAs have an effect on the market. Management Earnings Forecasts CEO Incentives and Risk-taking.

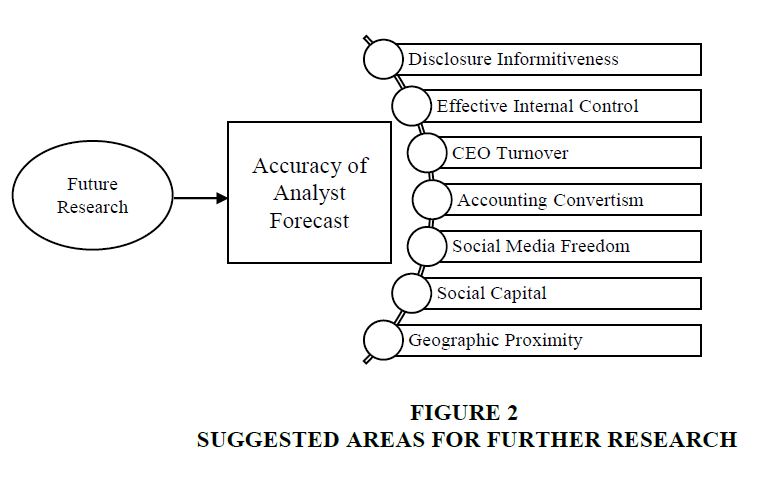

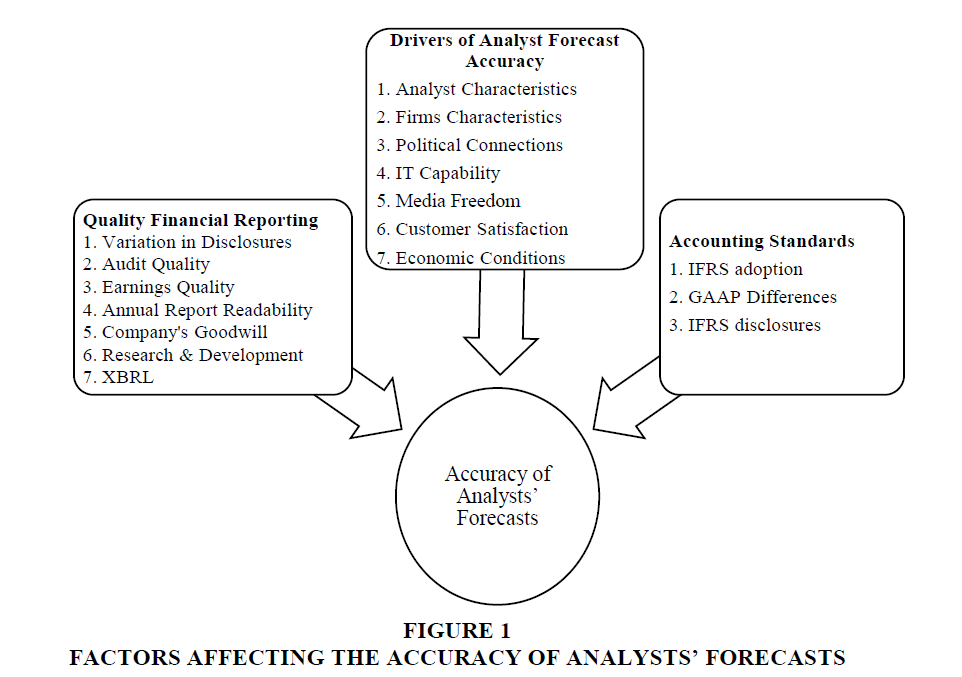

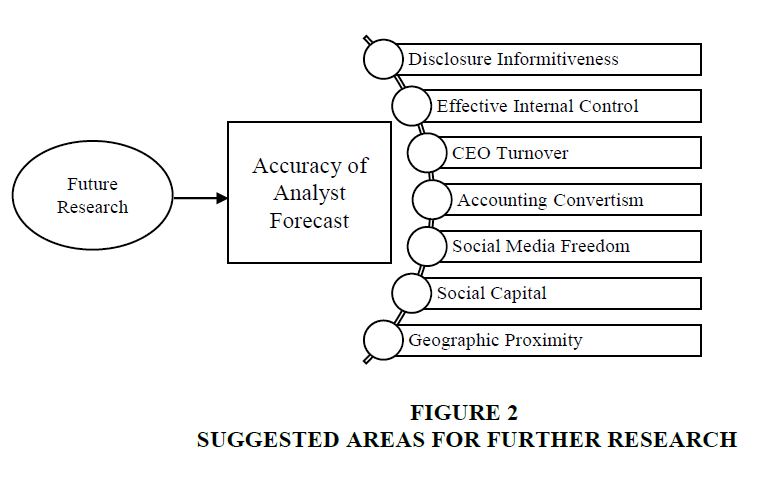

Factors Affecting The Accuracy Of Analyst S Forecasts A Review Of The Literature

Pdf Income Smoothing Earnings Management And The Credibility Of Accounting Information

Pdf Analyst Coverage And Earnings Management

Ownership Structure And Disclosure Quality Evidence From Management Forecasts Revisions In Japan Sciencedirect

Ceo Ability And Management Earnings Forecasts Baik 2011 Contemporary Accounting Research Wiley Online Library

Factors Affecting The Accuracy Of Analyst S Forecasts A Review Of The Literature

Pdf Ifrs Adoption Corporate Governance And Management Earnings Forecasts

Pdf Earnings Management In V4 Countries The Evidence Of Earnings Smoothing And Inflating

Pdf Corporate Governance And Earnings Management A Survey Of Literature

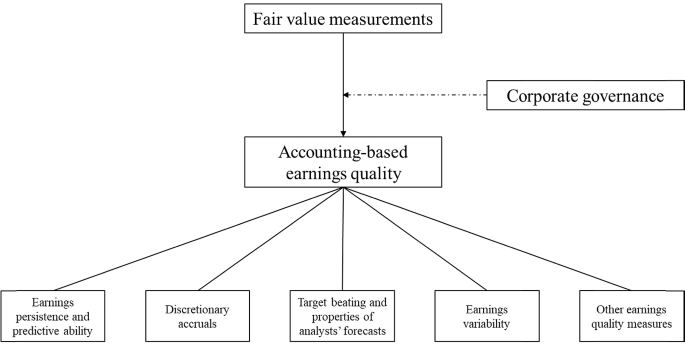

Do Fair Value Measurements Affect Accounting Based Earnings Quality A Literature Review With A Focus On Corporate Governance As Moderator Springerlink

0 Response to "management earnings forecasts"

Post a Comment